Expand Globally with Real-TimeRReeaall--TTiimmee Credit Insight

Leveraging CreditCliq’s API to access instant global credit insights helps your business deliver personalized offers and expand revenue potential across borders.

Fintechs

Access real-time credit data and streamline banking with our API.

Utilize our API for seamless access to real-time credit data, enhancing your services and expanding your market reach.

Banks

Build Trust with Transparent Data

Leverage our API to access real-time credit data, streamline decision-making, and enhance your financial offerings.

Super API for Global Credit Data

Our API offers smooth integration with your platform, delivering real-time global credit data to help you make smart financial decisions effortlessly.

Easy Integration

Our API is designed for quick and seamless integration with your existing systems, allowing your team to focus on what really matters.

Instant Access to Credit Data

Get real-time global credit data at your fingertips, enabling your organization to make informed decisions swiftly and confidently.

Empower Your Decisions

Leverage comprehensive insights from our API to enhance your financial strategies and drive better outcomes for your organization.

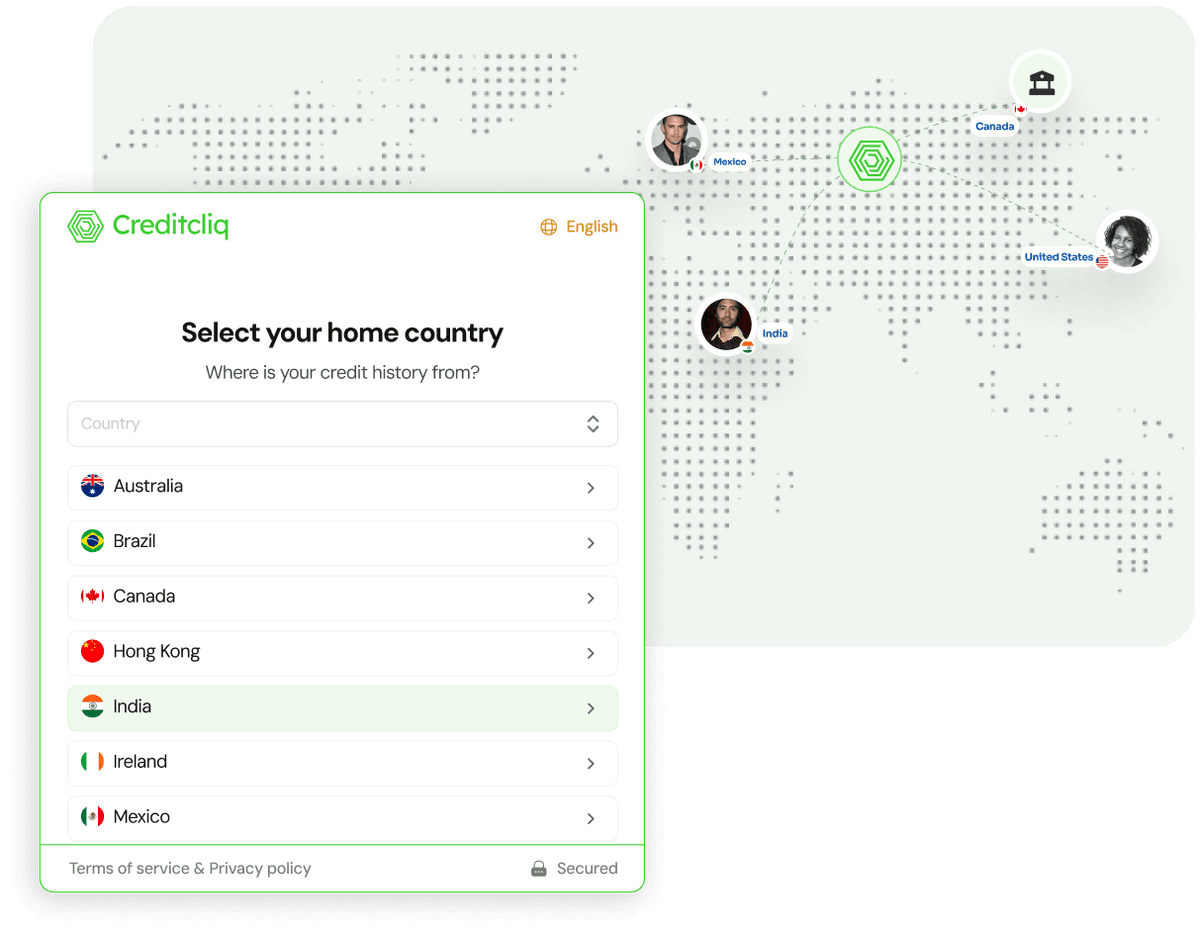

Your Global Credit Report Agency

Every year 2 million+ newcomers come to the US & Canada. CreditCliq helps business underwrite credit to newcomers while reducing default risk by accessing your customers' global credit report.

Financial institutions

Improved Loan Offerings

Use international credit histories to create tailored and competitive financing options for ITIN customers.

Expanded Customer Access

Include international customers who may be overlooked by other lenders, increasing the pool of potential buyers and boosting loan volume.

Strengthen dealer partnerships

Provide dealers with comprehensive international credit data, enabling them to better assess customers and close deals more effectively, fostering stronger relationships.

Indirect Lending

Build stronger relationships

Seamless onboarding and recognition of international credit histories foster customer trust and long-term loyalty.

Increased Loan Approval Rates

Boost more loan approvals and expand you’re customer base by leveraging comprehensive global credit histories to identify trustworthy international borrowers.

Tap into new markets

Attract expatriates, international students, and immigrants, expanding and diversifying the customer base.

Landlords

Faster Lease Approvals

Quickly verify international credit histories, accelerating lease approvals and reducing vacancy periods

Improved Tenant Screening

Evaluate international tenants more accurately, reducing the risk of defaults and ensuring a steady rental income.

Minimize rental risks

Access comprehensive credit data to better assess financial stability, lowering the risk of rental arrears and property damage.

Grow Revenue by Extending your Offers to Global Citizens.

Make informed decisions that reflect the best interests of your organization with clear and accessible data at your fingertips

Lower credit risk

Mitigates the risk of loan defaults and unpaid credit card balances.

Accurate Identity Verification

Improves customer onboarding and satisfaction.

Boost profits

Expands market reach and boosts revenue.

Go live in three steps

CreditCliq provides financial institutions and organizations access to global credit reports.

Request a consultation

Book a meeting to discuss your organization needs.

Receive a bespoke plan

Get a customized solution tailored to your specific requirements.

Implement and Go Live

Integrate CreditCliq and start onboarding global citizens today.

Security

Deployed on Google GCP and AWS, CreditCliq is built to the highest of security standards, so your institutions data is always safe.

Comprehensive security accreditation.

Deployed on Google GCP and AWS.

Your data matters. Visit our trust center today!